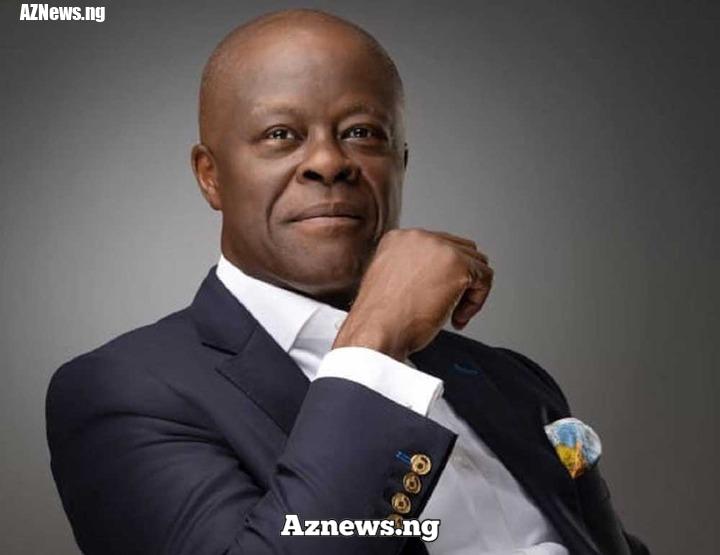

The Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun in this interview on AIT monitored by Kasarahchi ANIAGOLU of THE WHISTLER, spoke on issues affecting the Nigerian economy and steps being taken by the government to implement various economic and policy reforms that would address the rising inflation, naira volatility, and hunger in the country. EXCERPTS.....Read The Full Article>>.....Read The Full Article>>

Nigerians have been protesting the level of hardship in the country. What are the immediate steps the government is implementing to address hunger?

Mr. President stated a couple of days ago that the recent protest has been saddening, and the aftermath has led to the loss of life, destruction of property, and violence. That is very, very saddening. And, of course, to continue to call for an end to the protest and the embracing of dialogue.

We should never stop taking the opportunity, and the door is wide open for dialogue with all sections of the population. Having said that, a heightened cost of living, as we know, is a fallout of the macroeconomic reforms. Before I come to the issue of the specific measures being taken now, it is important to lay the background that when these decisions were taken by Mr. President, both courageous and necessary decisions, the country was on the verge of bankruptcy.

There was no way we could sustain living on borrowed time and living on borrowed money. That was put to an end by stopping the wasteful expenditure on subsidies and also by stopping the ill-managed and very opaque foreign exchange regime.

It was known that taking measures and implementing those measures, would lead to a spike in the cost of living. It would be inflationary in the short term. That was known, and that was why the measures to counteract the spike in the cost of living were put in place. I must say that the measures have been successful. They are bringing the economy to where it should be. The revenue of the government, which it needs, is growing, the exchange rate is stabilizing, the deficit is reducing, and foreign exchange inflows are being attracted into the country.

And so, at the macroeconomic level, the amount spent on debt as a percentage of revenue is falling sharply. So, at the overall level, at the macro level, and at the fundamental level, things are falling into shape. The issue is that at the micro level, there’s yet to be a drilling down to where people experience life. This is because, in a macroeconomic reform process, the costs come first, and then the benefits begin to come through. That is why a well-measured and well-tailored intervention program is necessary.

With the heightened cost of food, what matters now is that the intervention is to put food in the marketplace that is plentiful, that is affordable, and as you know, there’s been distribution and is the ongoing distribution of free food by the government through the states and other bodies.

Is there a monitoring process as to how these foods are being shared?

Twenty trucks each were given to all the states, and there is further distribution of rice by the government, free of charge, in addition, the markets will feel the benefit of rice at a subsidized price to help influence the current market price and to help bring out what is in the stores that may be hoarded and being kept aside and being speculated upon. It will help to bring out an inventory of food and rice in particular. So, there is an attempt to immediately impact the price of food, that’s in the immediate time, and linked to that is the people’s ability to afford that food.

The distribution is a release from reserves to help people overcome the immediate term. The answer in the short, medium, and long term is for Nigerians to produce, grow, harvest, and process their food.

In that sense, we have underway currently an initiative to produce maize and rice. We have an initiative in line with the World Bank. We have repurposed funding available on the Nigerian Agricultural Growth Scheme of the African Development Bank, together with some funding from the Japanese International Cooperation Agency that is going to produce 250,000 hectares of maize and will produce about 800,000 metric tons.

In addition, at the same time, there will be 500,000 hectares of rice, which is going to be planted, and that will produce about 1.5 million metric tons of rice. So, these are in the immediate term for the next season. We are almost out of the first planting season. We accept that, but we are still going to chase the last of this current planting season.

And the next dry season, we will have fertilizer, and seeds will be provided to the small-scale farmers in particular.

But as I mentioned, the amount of acreage that will be planted is the answer to food affordability and food availability. One thing that we learned from the past was that despite the difficulties, in the last maize season, 277,000 hectares of wheat were planted, and it was very successful. But we do have the issue of food going across the border, which is one of the issues in terms of food supply. But the point here is that there is a concerted effort to ensure that we have homegrown food available.

In the short term, as you said, there is, apart from what is being distributed from reserves, there is a window that has been opened for importation. Because the commitment of Mr President is to drive down those prices now and make food available now.

Experts have argued that the 150-day import duties suspension will discourage local food production. What is your take on that?

It is not going to be at the expense of our local farmers. One of the conditions for this importation will be that everything available locally in the markets or with the millers and so forth has been taken up.

We will have auditors that will check that. The condition on which people will be able to import is that they have gone and they have patronized local farmers. That is what will stop our local farmers from being discouraged by this emergency measure, with the kind of food production program we have, inflation will come down as prices come down. When inflation comes up, the exchange rate will stabilize, interest rates will come down and the economy will have a chance. People will have a chance at reasonable rates to invest in various sectors of the economy, increase productivity, grow the economy and create jobs, which is the key to reducing poverty, also we have the cash transfer program.

There has been controversy around the conditional cash transfer scheme. Who are the beneficiaries of these cash transfers as Nigerians are faulting the program?

As you know, we have a direct benefits program to transfer money directly to the pockets and to the accounts of the poor and the most vulnerable, which Mr. President always said he would not leave behind.

We started that process late last year. It ran into difficulties of transparency, honesty, and integrity. So it has been revamped, and it was started again in March using technology, making sure that each individual was identified biometrically.

They were paid through a bank account or a mobile wallet. They were paid digitally. It started again in March. It took some time to ramp up. But now, the first payments are running at one million per month. So, one million households are being paid per month.

The essence of the biometric is to identify how much was received and where they received it. And to save the privacy of people, and it will start maybe at the ward or the local government level.

When you talk about the transfers, the whole point of resetting is that we will be able to provide a dashboard. We will be able to say these are the people who have received these funds. Those dashboards are ready, and in due course, they can and will be publicized. People will be able to scrutinize them. That was the whole point of resetting their direct payments. And why I’m emphasizing this is that we are in a reform process, which is midstream.

What is the current status of beneficiaries in the conditional cash transfer program?

Right now, it’s about 4.3 million. But the last million was in the last few weeks. And when I say we’re ramping at a rate of one million a month, that is an ongoing process. We are expecting to be able to do one million a week or one million every two weeks. We keep increasing.

Once you have your technology right, you can now increase and as I said, why we need to have the ability to reach people quickly and there will always be a time when you want to intervene on behalf of the poorest and the most vulnerable.

Where is this money for the intervention coming from? Is it borrowed?

When we talk about borrowing, this particular money, $800m, is under a World Bank program, but it’s under an International Development Association program. And that money is for 40 years at one per cent.

So if you say it is borrowing, well, it is, but it is the softest and the cheapest and the most affordable form you can get. The rest will come from the Nigerian federal budget.

There is the presidential committee on fiscal reforms, fiscal policy and tax reforms. What is the status of the recommendation on the executive order of inflation, reduction and emergency economic intervention?

I think the best way to answer that without evading it, is to point out that in undertaking the reforms that were very necessary for the economy, there was also side by side a full program of interventions that dealt with every section of society and every sector of the economy.

So, therefore, there are direct payments to the poorest and the most vulnerable. There are seeds, and fertilizers for farmers to bring new acreage to their production, as well as other incentives, including relative funding.

For the nano enterprises, there are N50,000 grants for 1 million nano enterprises. For the small and medium scale, there is N1m funding at 9 per cent per annum. And then, for the bigger, medium-sized enterprises, there is also up to N1bn financing at nine per cent per annum.

So, that dealt with all those, and it’s also a way to make sure we increase production and all these things are aimed at bringing down inflation.

And then for the largest companies. There are the import waivers and the fiscal measures to help them bring down their costs withholding tax eliminated for the manufacturing sector as a whole and small-scale businesses as well so that their working capital is preserved.

The African Development Bank has said that Nigeria’s inflation is more than the West African average, as Coordinating Minister, what kind of coordination is going on between monetary and fiscal policy despite the Central Bank heightening Interest rates, which seem not to control inflation and government addition spending to this year’s budget?

Even as the Central Bank is leading the charge in the fight against inflation, we need to grow the economy. And I’ll give you one or two instances where we have done that, taking equity, taking our savings to do that.

And there are two critical areas. One is when you look at the Private-Public Partnerships for major infrastructure projects that are linking all the ports and all the states of the south with the Lagos to Calabar Highway, as well as the Sokoto Badagri Highway, which is linking so much farmland, dams, towns and villages coming from north to south.

Those are being funded with Private-Public Partnerships, but with the government finding its equity to put down. And of course, you can imagine the construction-related boom that is flowing from those particular projects.

The other area in which we are attempting while fighting inflation is to grow the economy, and America did it successfully, not many others did, but America while bringing down the rate of inflation was also growing, and that’s what we are determined to do.

The other area is that we have savings, and we have found a way of taking within the limits of the law. And I’ll emphasize that Mr President stands for the rule of law, a level playing field and the sanctity of contracts.

Within the law, we have approval, and we’ll shortly be announcing a real estate fund, which, on the one hand, our pension funds can invest in within their limits at their normal rates of return. And at the same time, we blend it with some of this concessional financing at one per cent.

As a result, we will be able to write for Nigerians 25-year low-interest mortgages. That in itself will spark a boom in housing construction because once you have off-takers for property, the banks will finance construction, and the developers will go to town.

That is a major driver that we are looking to grow the economy at the same time, fighting inflation, which the central bank governor has indicated is a priority of the central bank and is well within its mandate.

But also, in terms of coordination, the Permanent Secretary of Finance is on the monetary policy committee. In addition, we have a monetary and fiscal coordination committee that meets regularly.

So the government, through the Ministry of Finance and the Debt Management Office, took on the challenge of paying higher interest rates on our domestic debt so that we could help the central bank achieve its inflation target, but more importantly, attract foreign flow into the country, which has helped the central bank to pay down virtually all of its outstanding foreign obligations.

So that’s where you get the coordination of monetary and fiscal opportunities. I know it sounds a bit high-level and complex, but it’s important to just say that we are on the same page in a very robust way.

So the central bank does not, and we have not gone to the central bank to say, please lend the government money to pay its debt, to pay its salaries.

We have not gone. We have used market instruments to pay down what we owe, and that is a very important aspect of having a strong economy.

Attention has been drawn to increasing ways and means of government from five to ten per cent, why is that?

I think the legislators, do have a right to pass laws as they see fit. And I think what happened here was that there was old legislation, which they had passed for a 15 per cent limit on ways and means.

This means 15 per cent of last year’s revenue is the limit the government could borrow temporarily. If you obey the letter of the law, wherever it goes, you have to pay it down by the end of the year, just like people do at the end of the month with their credit cards.

But the point here is that it was raised to 10 per cent. It doesn’t mean it would be used. It doesn’t mean it would be used. It’s there as it feels safe. Sometimes it just gives that extra flexibility so that if a payment needs to be made and a mistiming, there’s a gap between the time at which the revenue will come in and the expense is needed, you can just draw down briefly.

So the aim is to keep within the letter of the law, I think that’s the main point.

Experts have said that Nigeria doesn’t have a revenue problem, but government officials spend on frivolous things at the expense of vulnerable Nigerians. Can you speak on that?

When you look at the budget, essentially, when you look at the recurring budget, it is mainly personnel costs, salaries and pensions. And the overhead, which is what the ministries spend on themselves, the ministries, departments and agencies, is relatively small, maybe 10 per cent, so that’s not an area to look for, huge savings.

The way to look is the quality of spending on projects. And in that sense, what has happened is that to bring greater visibility and, of course, greater accountability to the public posts, and to the money of Nigerians that is spent on capital projects, we’ve implemented something akin to exactly what happened with the direct benefits, direct payments program.

There was a time when the payments were going out in bulk, whereas now they go directly to each identified individual in their account, which is as it should be. That is the improvement.

That same improvement has been made under the 2024 capital budget, where once procurement is complete, the payment is not made to a ministry or a third party. The payment goes directly to the consultant, the contractor, the supplier, and the counterparty of the government.

And that will have a huge effect on the quality of spending across the board in terms of timeliness, in terms of efficiency, in terms the fact that funds will go directly to who they should go to.

And so that is an innovation under the 2024 budget and it is in line with what Nigerians expect. Quality, visibility, efficiency, and integrity of spending of the tax money.

Is Nigeria still paying for fuel subsidies? If yes, where is that money coming from?

The fuel subsidy was removed on May 29, 2023, by Mr. President. And at that time, the poorest, 40 per cent were only getting four per cent of the value.

So basically, they were not benefiting at all. So it was going to be just a few. The other point I think is important to make is that nobody knows the consumption in Nigeria of petroleum.

We know we spend $600m every month on importation. The issue here is that all the neighbouring countries are benefiting, so we are buying not just for Nigeria, we are buying for the countries to the east, almost as far as Central Africa, we are buying for countries to the north, and we are buying for countries to the west.

And so we have to ask ourselves, how long do we want to do that for? I think that’s the key issue regarding this issue of petroleum pricing. We should block our borders. There’s a level of incentive at which it is like trying to hold the sea back.

There’s a level of incentive financially, there’s a level at which if the two prices are different, those who are willing to invest in low and sell high and pay some costs will be determined because the rewards for that type of behaviour are huge.

There’s no fuel subsidy in the budget. There’s no fuel subsidy in the budget. That is the truth. That is a technical fact.

Bank Directors in Nigeria have kicked against the windfall tax, what is the government’s position on that?

It was passed as a levy, so it’s not a tax. In terms of the windfall levy, I think where you have on-hand income, where you have a section of the society or an industry or a set of companies that earn money through new, not through dint of hard work of their own, the society deserves a chance to share some of that.

And it’s just redistribution of that. So I think that takes care of the issue of the windfall levy. It’s done everywhere else in the world where you have, especially in the energy sector as well as banking.

The debt-to-GDP ratio is 49.5 per cent, what are the measures in place to bring it down?

In terms of the debt, the idea is that as we grow our revenue, as we grow our GDP, as we grow the economy, and the economy is growing, and it is growing above the population growth. That will take care of the debt to the GDP level.

How much are the World Bank and IMF, influencing our policies?

They give us advice, and we do take concessional financing from the World Bank. As for the IMF, more often than not, we disagree with them, and we don’t have anything from them other than what was inherited during the Covid financing.